How to Save Your Loss With Exit and Cancel Feature?

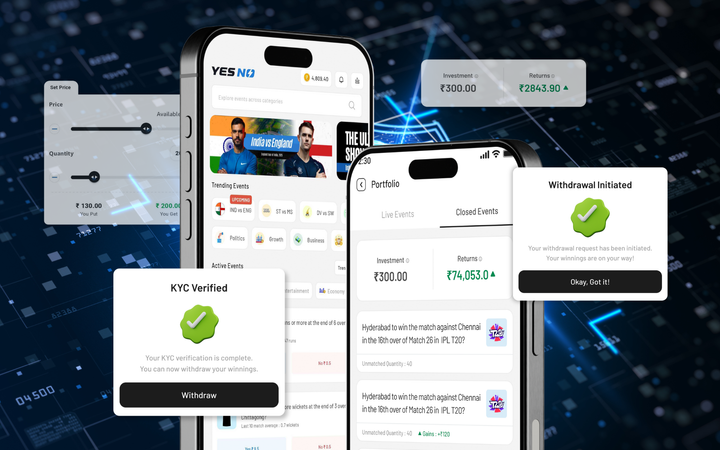

Predicting gaming is a new and exciting avenue for profit-making through the prediction of market movements. With such platforms as YesNo coming up with special features designed for the maximization of losses and optimization of strategies, two very important features are Exit and Cancel features that are used for giving flexibility and hands-on control over all trades. This blog will discuss the functionalities in detail and the strategies that can be used to maximize their use.

What is a Market Order?

You can purchase or sell volumes at the greatest prices in the market right now with a market order. In a market that moves quickly, market orders provide a dependable and quick way to enter or leave a deal. Almost immediately after placing a purchase at the best price, quantities are matched with market orders.

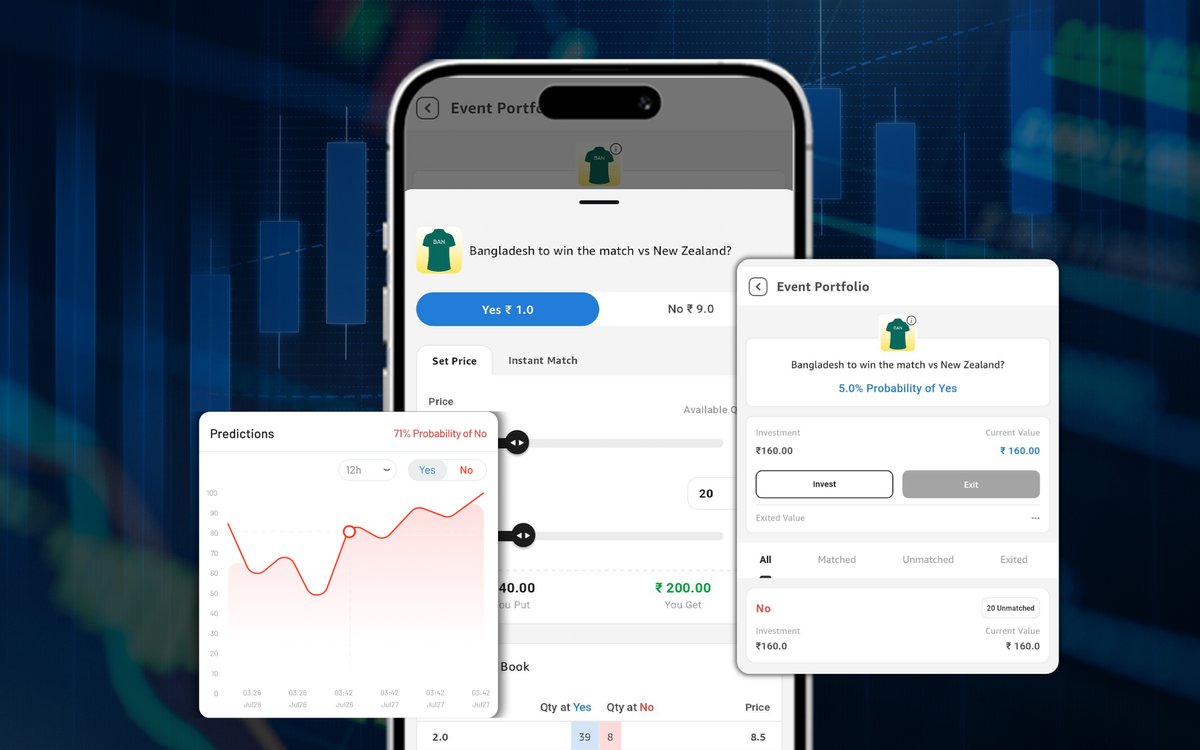

What is YesNo's Exit feature?

The exit function allows the trader to exit a position before any announcement regarding the outcome of an event. Traders would lock in their profits or losses depending on how the market moves. Exit price changes as per demand and supply and along with real-time market opinions. The user can leave the current trade by using the "Exit" feature. You might choose to leave for several reasons, including:

- Changes in the state of the market,

- Managing your losses

- making an early profit

- Just deciding to withdraw your Investment from an event

Types of Exit

Instant Exit: Instantly allows traders to exit from the trade and go at the current market price. It guarantees the liquidation of open positions without having to wait for the outcome of the event.

Partial Exit: In this, a trader can exit much less than the overall position and keep the rest active. It can secure partial profits or reductions in risk while still being involved in a trade.

Also Read: What is Bid, Match, Liquidity, and Role of Pricing In An Event

Why Are Exit and Cancel Features the Best for Users?

Risk management: the tools that allow traders to early cut losses and take profits if warranted, thus reducing their window of exposure to market volatility.

Flexibility: Traders can dynamically change their positions according to market sentiment without being forced to make a decision.

Quick adjustments: Opinion markets can behave with high unpredictability; exit and cancel options allow traders to respond instantaneously to shifts in market conditions.

Strategic control: Rather than treating a position as "on or off," traders can make use of partial exit and cancellation options to best manage their portfolios and offset risk.

Conclusion

The Exit and Cancel features empower users with enhanced control over their opinion trades. Via instant exits, partial exits, and partial cancels, traders can actively manage risks and maximize potential profits. It doesn't matter if you're a beginner or an expert; these strategies will help you to make educated and profitable decisions in the dynamic world of skill gaming.